Smart AI for Your Finances

Smart AI for Your Finances

Smart AI for Your Finances

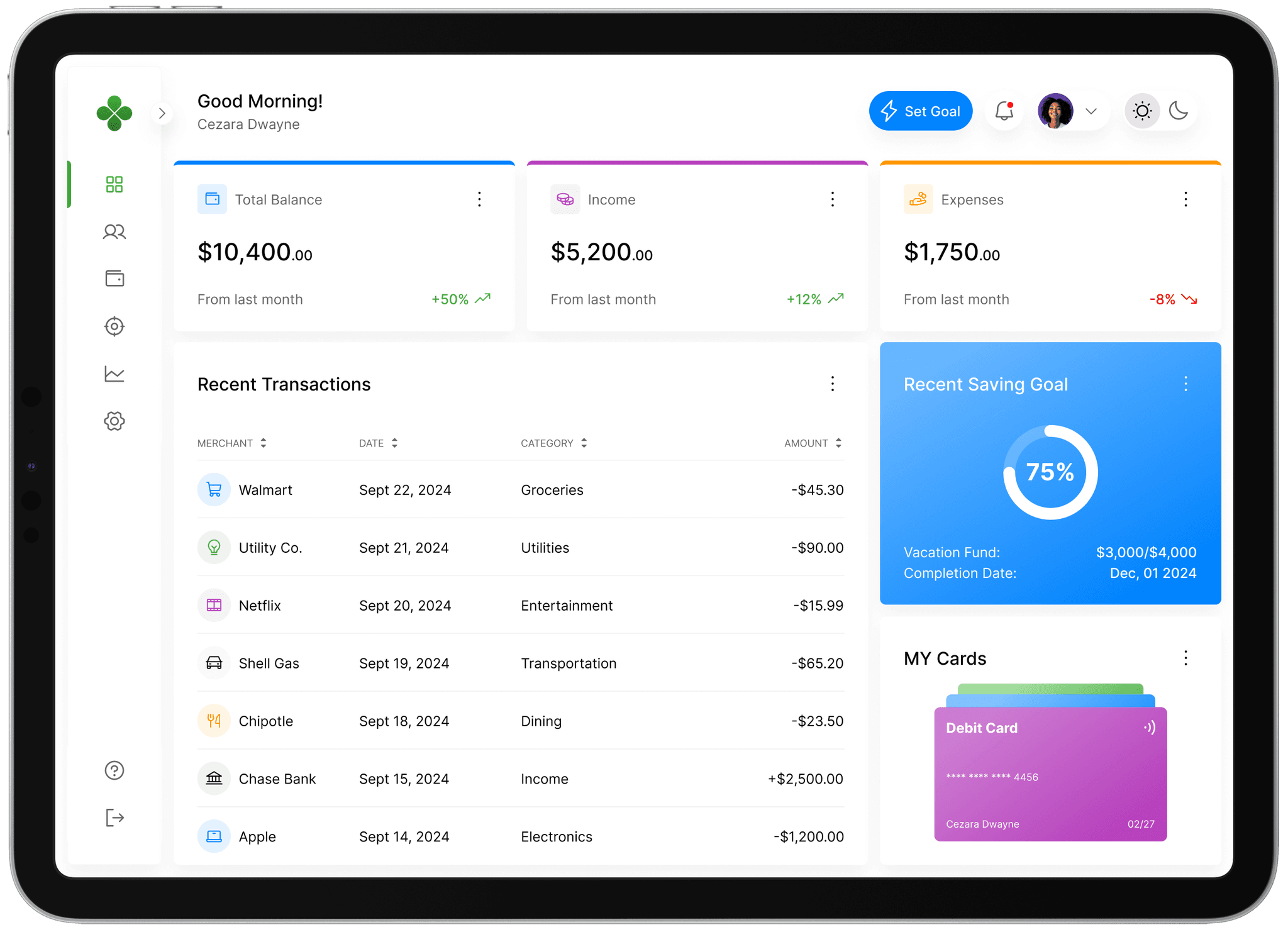

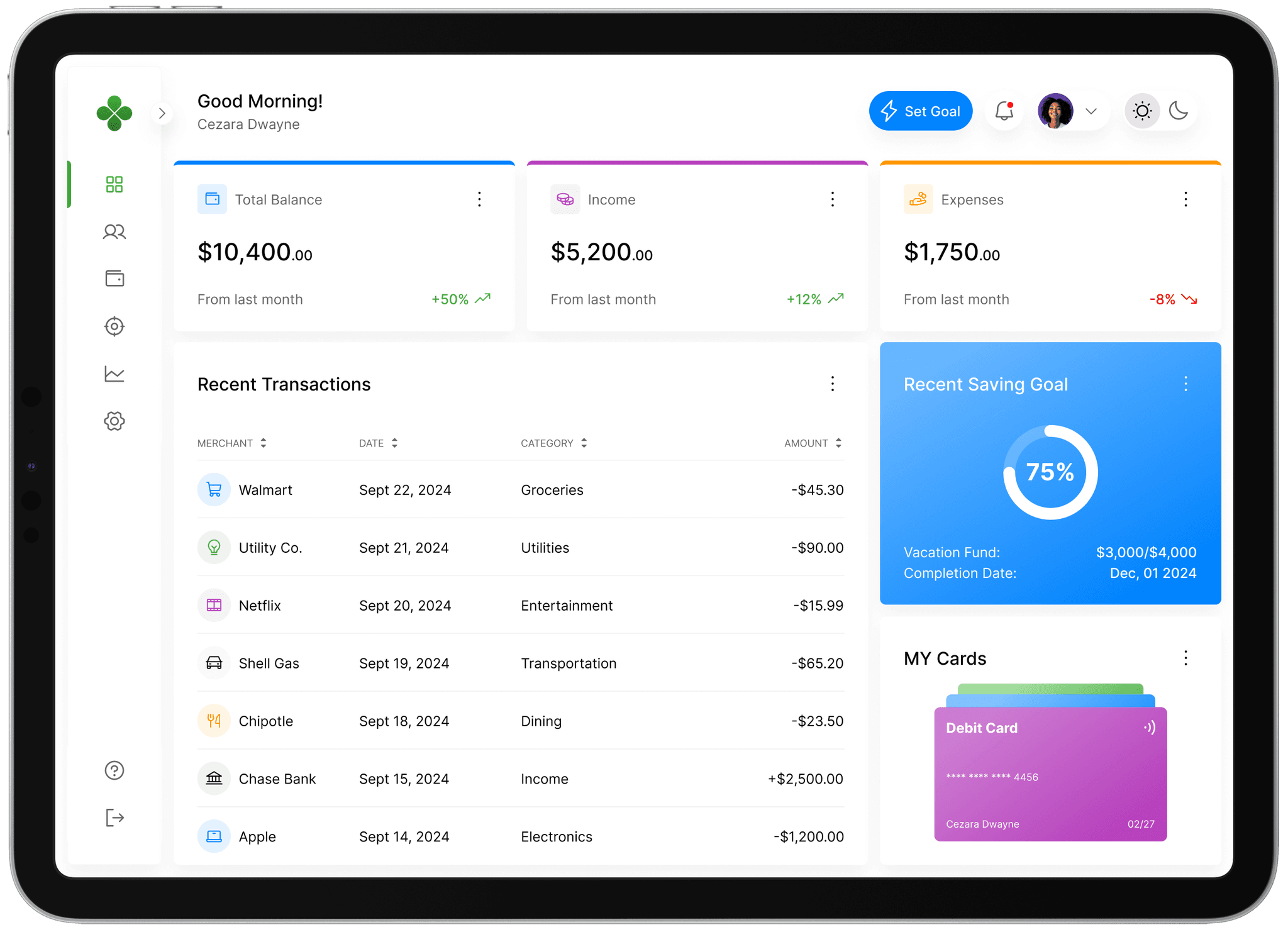

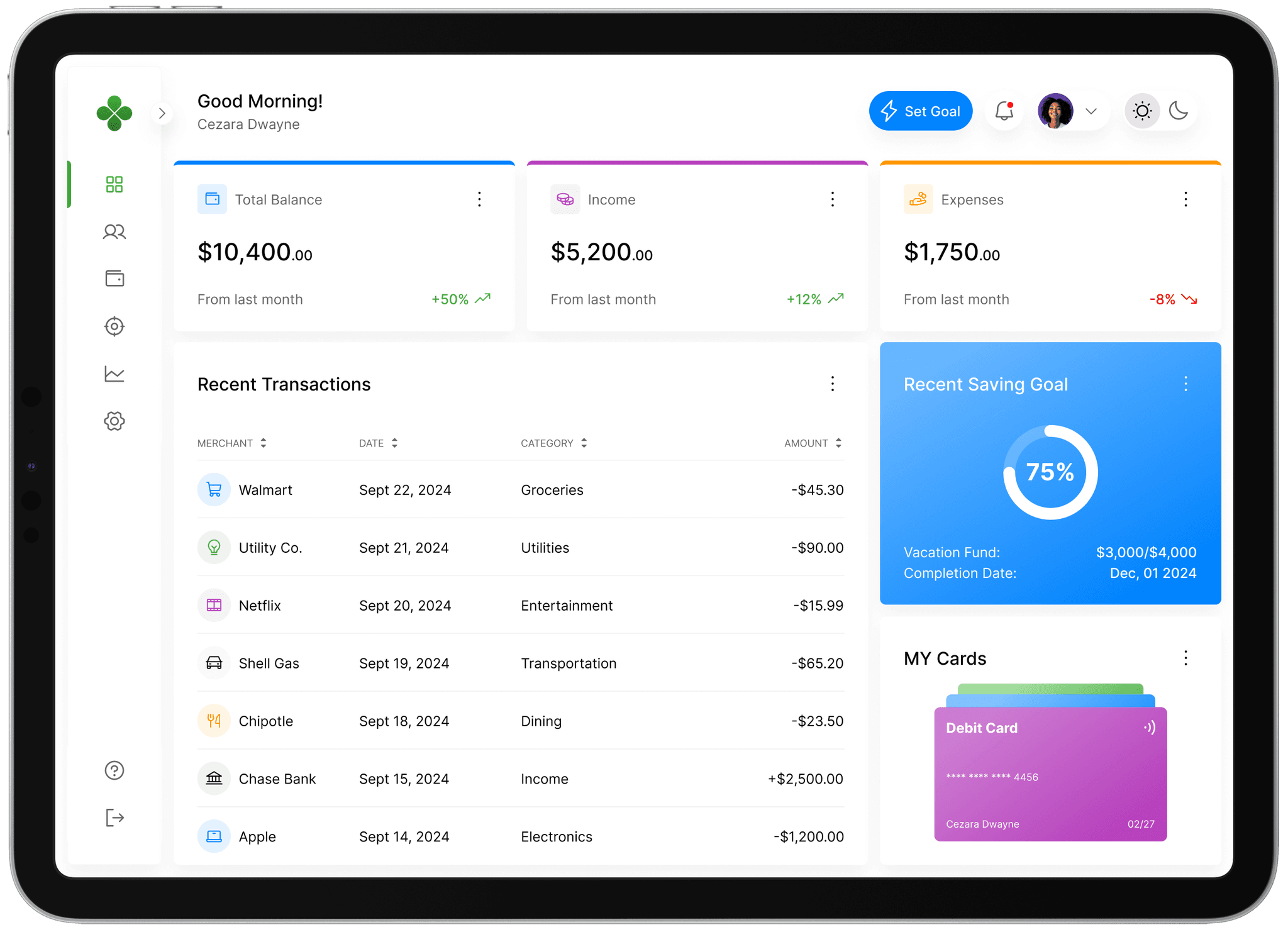

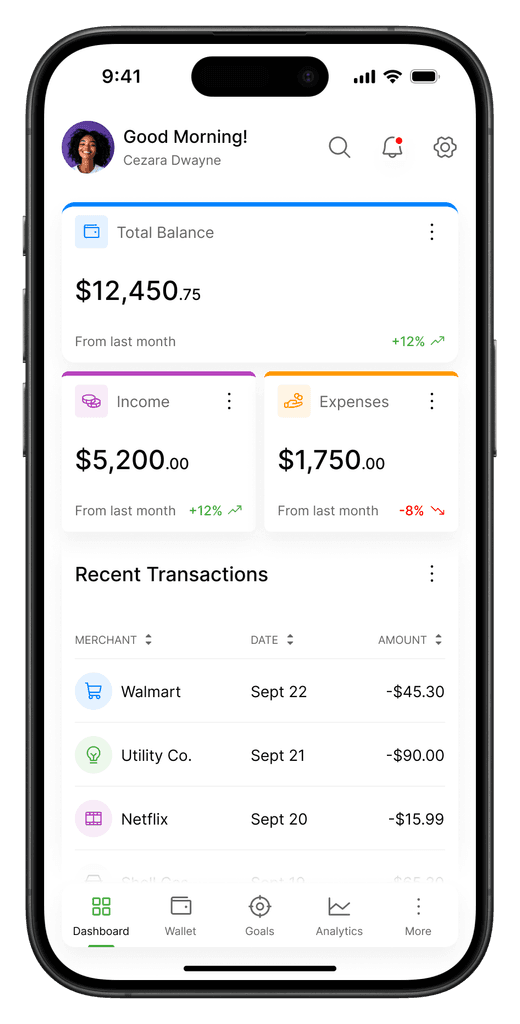

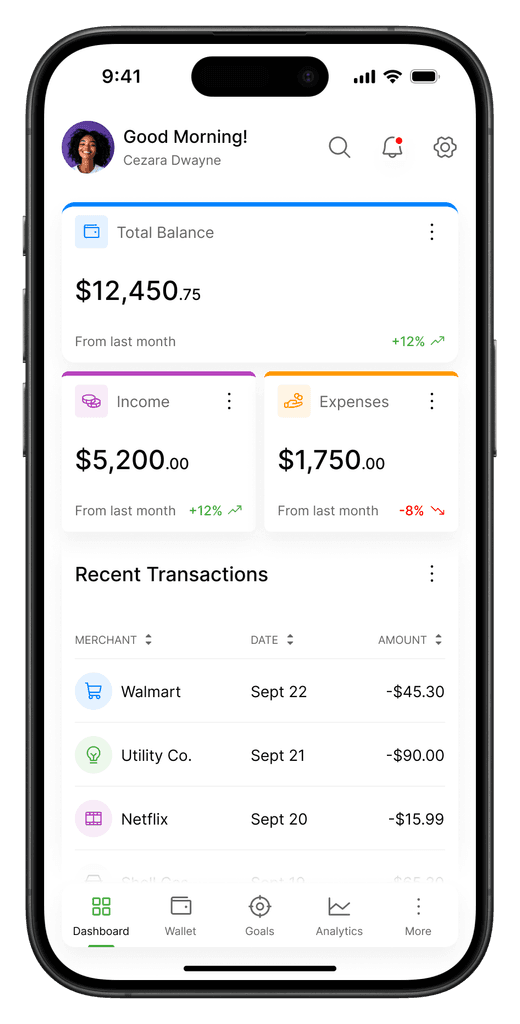

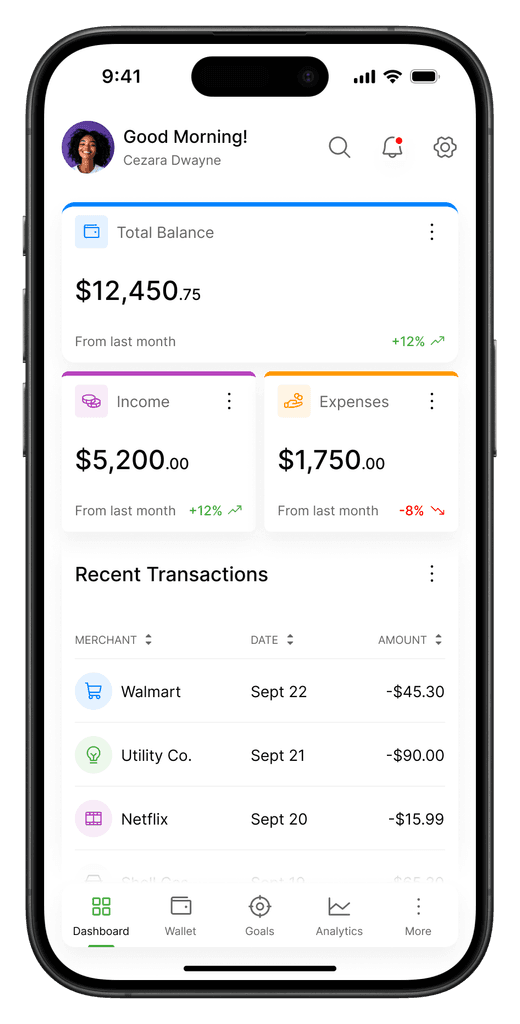

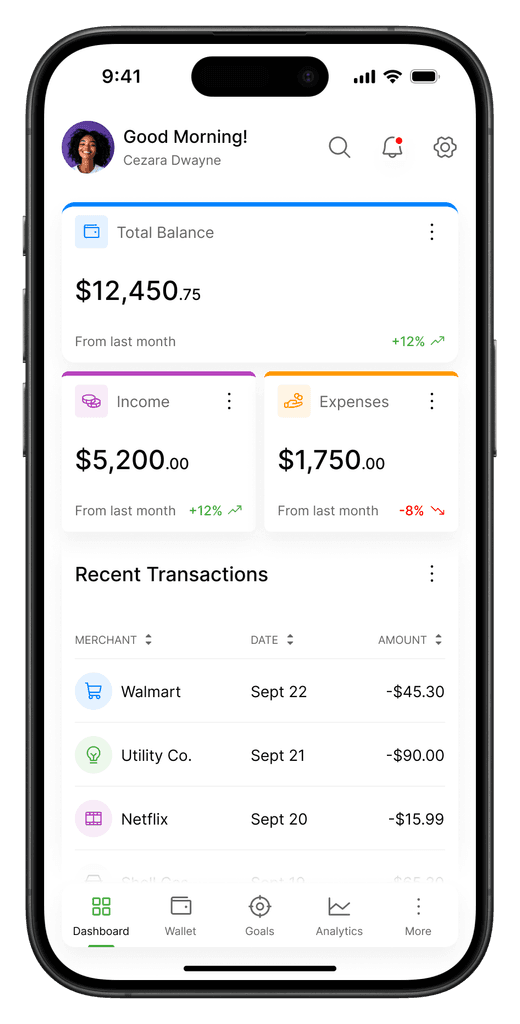

Your AI-Powered Financial Assistant

From detailed budgeting to custom savings goals, Volta seamlessly automates every step of your financial journey, helping you achieve lasting financial freedom with ease.

Impressive Features

Impressive Features

Impressive Features

Volta's Key Features

Explore the powerful tools Volta offers to help you take control of your financial journey.

Stress-Free financial Insights

Simplified insights for smarter financial decisions.

Reduces financial anxiety by simplifying complex data into actionable insights, leading to smarter spending and peace of mind.

Stress-Free financial Insights

Simplified insights for smarter financial decisions.

Reduces financial anxiety by simplifying complex data into actionable insights, leading to smarter spending and peace of mind.

Stress-Free financial Insights

Simplified insights for smarter financial decisions.

Reduces financial anxiety by simplifying complex data into actionable insights, leading to smarter spending and peace of mind.

Smart Budgeting Assistance

Personalized budgeting tools to reduce expenses and boost savings.

Makes budgeting easy, enabling users to identify unnecessary spending and improve monthly savings.

Smart Budgeting Assistance

Personalized budgeting tools to reduce expenses and boost savings.

Makes budgeting easy, enabling users to identify unnecessary spending and improve monthly savings.

Smart Budgeting Assistance

Personalized budgeting tools to reduce expenses and boost savings.

Makes budgeting easy, enabling users to identify unnecessary spending and improve monthly savings.

Goal-Oriented Savings Plans

Set and track financial goals with tailored support.

Helps users stay focused on their goals, offering motivational prompts and milestones to celebrate their progress.

Goal-Oriented Savings Plans

Set and track financial goals with tailored support.

Helps users stay focused on their goals, offering motivational prompts and milestones to celebrate their progress.

Goal-Oriented Savings Plans

Set and track financial goals with tailored support.

Helps users stay focused on their goals, offering motivational prompts and milestones to celebrate their progress.

Rewards and Recommendations

Personalized offers to support your financial journey

Allows users to benefit from curated offers that support their financial journey, adding value even for free-tier users.

Rewards and Recommendations

Personalized offers to support your financial journey

Allows users to benefit from curated offers that support their financial journey, adding value even for free-tier users.

Rewards and Recommendations

Personalized offers to support your financial journey

Allows users to benefit from curated offers that support their financial journey, adding value even for free-tier users.

Financial Roadblocks

Financial Roadblocks

Financial Roadblocks

Struggle Financial Situations?

We get it. Volta simplifies the process of tracking, budgeting, and saving, so you can stress less.

Problems

Struggling to track all your expenses in one place?

Overspending without realizing it?

Difficult to save for long-term goals?

Problems

Struggling to track all your expenses in one place?

Overspending without realizing it?

Difficult to save for long-term goals?

Problems

Struggling to track all your expenses in one place?

Overspending without realizing it?

Difficult to save for long-term goals?

Handle

Managing multiple accounts can feel overwhelming.

Without real-time updates, it's easy to lose track of spending.

Saving for long-term goals requires consistency and planning.

Handle

Managing multiple accounts can feel overwhelming.

Without real-time updates, it's easy to lose track of spending.

Saving for long-term goals requires consistency and planning.

Handle

Managing multiple accounts can feel overwhelming.

Without real-time updates, it's easy to lose track of spending.

Saving for long-term goals requires consistency and planning.

Solutions

Volta integrates all your accounts in one dashboard.

Receive real-time alerts when you're approaching your budget limits.

Set custom savings goals and let AI automate the path to reaching them.

Solutions

Volta integrates all your accounts in one dashboard.

Receive real-time alerts when you're approaching your budget limits.

Set custom savings goals and let AI automate the path to reaching them.

Solutions

Volta integrates all your accounts in one dashboard.

Receive real-time alerts when you're approaching your budget limits.

Set custom savings goals and let AI automate the path to reaching them.

Pricing Plans

Pricing Plans

Pricing Plans

Flexible Pricing for Every Lifestyle

Flexible Pricing for Every Lifestyle

Volta's plans offer you everything you need to manage your finances effortlessly, with options tailored to your unique needs.

Volta's plans offer you everything you need to manage your finances effortlessly, with options tailored to your unique needs.

BASIC - FREE

0 EGP

/month

- paid monthly

Ideal for Beginners getting started with budgeting.

Expense Tracking

Single Account Sync

Manual Budgets

1 Savings Goal

Payment Reminders

Points and Rewards

PLUS - POPULAR

399 EGP

/month

- paid monthly

For Users who want deeper insights into their finances.

All Free features

Automatic Budgeting

5 Savings Goals

AI Insights and Expenses predictions

Budgeting Consultations

Monthly Reports

More Points and Rewards

All Plus Features

Unlimited Savings Goals

Financial Forecasting

Savings/Investments Consultations

Automated Billing payment

Ai Chat like talking to your money

Offers on what you spend the most

More Points and Rewards

BASIC - FREE

0 EGP

/month

- paid monthly

Ideal for Beginners getting started with budgeting.

Expense Tracking

Single Account Sync

Manual Budgets

1 Savings Goal

Payment Reminders

Points and Rewards

PLUS - POPULAR

399 EGP

/month

- paid monthly

For Users who want deeper insights into their finances.

Unlimited Account Sync

Advanced Budgets

5 Savings Goals

AI Insights

Real-Time Alerts

Monthly Reports

Priority Support

All Plus Features

Unlimited Savings Goals

Financial Forecasting

Custom Reports

Expense Breakdown

Real-Time Insights

24/7 Support

Data Export

BASIC - FREE

0 EGP

/month

- paid monthly

Ideal for Beginners getting started with budgeting.

Expense Tracking

Single Account Sync

Manual Budgets

1 Savings Goal

Payment Reminders

Points and Rewards

PLUS - POPULAR

399 EGP

/month

- paid monthly

For Users who want deeper insights into their finances.

All Free features

Automatic Budgeting

5 Savings Goals

AI Insights and Expenses predictions

Budgeting Consultations

Monthly Reports

More Points and Rewards

All Plus Features

Unlimited Savings Goals

Financial Forecasting

Savings/Investments Consultations

Automated Billing payment

Ai Chat like talking to your money

Offers on what you spend the most

More Points and Rewards

Financial Management

Financial Management

Financial Management

Expense Tracking

Expense Tracking

Automatically track, categorize, and analyze all your expenses in real-time, across all connected accounts.

Automatically track, categorize, and analyze all your expenses in real-time, across all connected accounts.

Real-Time Updates

Real-Time Updates

Real-Time Updates

Automatic Categorization

Automatic Categorization

Automatic Categorization

Unified Account View

Unified Account View

Unified Account View

Detailed Spending Insights

Detailed Spending Insights

Detailed Spending Insights

Financial Management

Financial Management

Financial Management

Multi-Account Sync

Multi-Account Sync

Effortlessly link all your bank accounts, credit cards, and payment platforms in one dashboard for a unified view of your finances.

Effortlessly link all your bank accounts, credit cards, and payment platforms in one dashboard for a unified view of your finances.

All Accounts in One Place

All Accounts in One Place

All Accounts in One Place

Financial Management

Financial Management

Financial Management

Real-Time Synchronization

Real-Time Synchronization

Real-Time Synchronization

Financial Overview

Financial Overview

Financial Overview

Financial Management

Financial Management

Financial Management

Custom Budgets

Custom Budgets

Create personalized budgets for specific categories like groceries, entertainment, and transportation, and monitor your spending against these limits.

Create personalized budgets for specific categories like groceries, entertainment, and transportation, and monitor your spending against these limits.

Personalized Spending Limits

Personalized Spending Limits

Personalized Spending Limits

Real-Time Budget Tracking

Real-Time Budget Tracking

Real-Time Budget Tracking

Flexible Adjustments

Flexible Adjustments

Flexible Adjustments

Visual Spending Alerts

Visual Spending Alerts

Visual Spending Alerts

Smart Savings

Smart Savings

Smart Savings

Optimize Your Savings Journey

Whether it's a vacation or an emergency fund, we'll help you get there faster.

Alerts & Insights

Alerts & Insights

Alerts & Insights

Real-Time Budget Alerts

Spending Habit Analysis

Bill Reminders

Financial Forecasting

Real-Time Budget Alerts

Stay informed with instant notifications when you're approaching or exceeding your budget limits, helping you make timely adjustments and avoid overspending.

You’re over your Grocery Budget by $50 this month.

01:00 PM

Your Entertainment Budget is almost maxed out!

02:00 PM

You’ve spent 80% of your Dining Budget!

03:00 PM

Real-Time Budget Alerts

Spending Habit Analysis

Bill Reminders

Financial Forecasting

Real-Time Budget Alerts

Stay informed with instant notifications when you're approaching or exceeding your budget limits, helping you make timely adjustments and avoid overspending.

You’re over your Grocery Budget by $50 this month.

01:00 PM

Your Entertainment Budget is almost maxed out!

02:00 PM

You’ve spent 80% of your Dining Budget!

03:00 PM

Real-Time Budget Alerts

Stay informed with instant notifications when you're approaching or exceeding your budget limits, helping you make timely adjustments and avoid overspending.

You’re over your Grocery Budget by $50 this month.

01:00 PM

Your Entertainment Budget is almost maxed out!

02:00 PM

You’ve spent 80% of your Dining Budget!

03:00 PM

Seamless Connections

Seamless Connections

Seamless Connections

Integrate with Your Favorite Tools

Connect all your financial accounts and apps effortlessly to manage your money in one place.

Customer Experiences

Customer Experiences

Customer Experiences

How Payble is Changing Lives

Read real stories of how Payble has helped users improve their financial health and reach their goals.

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

Sarah Williams

Sarah WilliamsMarketing Manager

"Volta has completely transformed how I manage my money. Before, I always felt overwhelmed by my expenses, but now I’m on track with my savings and finally have control over my budget!"

Ahmed Rayan

Ahmed RayanSmall Business Owner

"Managing both personal and business finances was a challenge until I found Volta. Now, I have a clear view of my expenses and income, which has taken a huge weight off my shoulders."

Mariam H.

Mariam H.Software Developer

"Volta has helped me save for my dream vacation faster than I ever thought possible. The progress tracking and real-time insights make it simple to stick to my financial goals."

Abdelrahman A.

Abdelrahman A.Freelance Graphic Designer

"As a freelancer, I’ve struggled to manage fluctuating income. Volta AI insights and savings goals have made it so much easier to plan for the future and manage my finances stress-free."

FAQ

FAQ

FAQ

Common Questions & Answers

Common Questions & Answers

Here’s everything you need to know about Volta, from features to getting started.

Here’s everything you need to know about Volta, from features to getting started.

How do I link my bank accounts to Volta?

To link your bank accounts, simply go to the "Accounts" section in the app, select "Add Account," and follow the secure authentication process. Volta supports most major banks and credit cards, making it easy to integrate your financial data.

Is Volta secure to use with my financial information?

Can I set multiple savings goals?

How do real-time budget alerts work?

Can I use Volta with multiple accounts and credit cards?

What insights does Volta provide about my spending?

Is there a free version of Volta?

How do automated savings work?

How do I link my bank accounts to Volta?

To link your bank accounts, simply go to the "Accounts" section in the app, select "Add Account," and follow the secure authentication process. Volta supports most major banks and credit cards, making it easy to integrate your financial data.

Is Volta secure to use with my financial information?

Can I set multiple savings goals?

How do real-time budget alerts work?

Can I use Volta with multiple accounts and credit cards?

What insights does Volta provide about my spending?

Is there a free version of Volta?

How do automated savings work?

How do I link my bank accounts to Volta?

To link your bank accounts, simply go to the "Accounts" section in the app, select "Add Account," and follow the secure authentication process. Volta supports most major banks and credit cards, making it easy to integrate your financial data.

Is Volta secure to use with my financial information?

Can I set multiple savings goals?

How do real-time budget alerts work?

Can I use Volta with multiple accounts and credit cards?

What insights does Volta provide about my spending?

Is there a free version of Volta?

How do automated savings work?

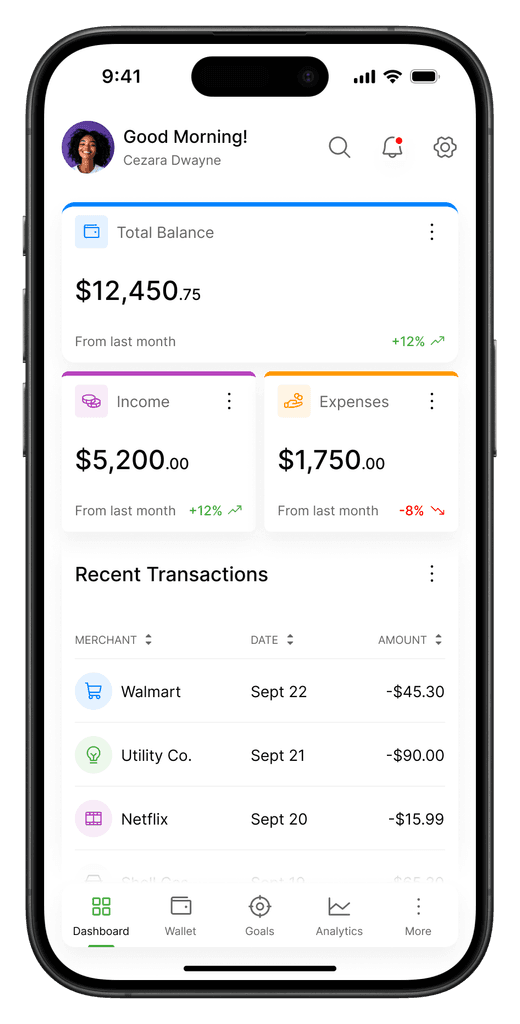

Download Mobile App

Manage your finances with the Volta mobile app. Download it today for easy expense tracking and customized alerts.

Download Mobile App

Manage your finances with the Volta mobile app. Download it today for easy expense tracking and customized alerts.

Download Mobile App

Manage your finances with the Volta mobile app. Download it today for easy expense tracking and customized alerts.

Subscribe to Newsletter

Subscribe today to receive personalized financial tips, news, and updates delivered directly to your email.

Subscribe to Newsletter

Subscribe today to receive personalized financial tips, news, and updates delivered directly to your email.

Subscribe to Newsletter

Subscribe today to receive personalized financial tips, news, and updates delivered directly to your email.